Nomad

News

Mapping Cybercriminality: US States Most Targeted by Phone and Mobile Scams in 2025

States Most Targeted by Phone and Mobile Scams in 2025

As scams are constantly evolving, phone and mobile fraud remains one of the most prevalent threats facing Americans in 2025. From robocalls to phishing texts, cybercriminals are finding new ways to exploit trust and technology.

To uncover where scams cause the most damage, Nomad eSIM analysed data from Fraud and ID Theft Maps by the Federal Trade Commission for the first half of 2025. We created a comprehensive ranking that weighs multiple factors including report volume, per-capita rates, median losses, and total financial damage. But we also broke the data down to show which states suffer the highest number of reports, which states endure the greatest financial losses, and where the damage per resident is most severe.

Key takeaways:

- The combined ranking shows that Florida is the most burdened state by scams when weighing all factors, followed by Arizona, and Georgia.

- By raw numbers, California and Texas dominate report volume and financial losses, but per capita, smaller states like Maryland and Missouri face just as much danger.

- Arizona loses more per incident ($670) than anywhere else.

- Delaware was the most scammed state by 100k population in the first half of 2025 for mobile scams (14.52).

Overall Ranking: States Most Affected by Scams in 2025

1. Florida - 189/200

Florida tops the list for mobile and telephone scams. In the first half of 2025, the Sunshine State recorded 3,199 scam reports, amounting to 13.4 reports per 100,000 residents. In terms of financial damage, Floridians reported $1.64 million in total losses, with a median loss of $513 per victim.

2. Arizona - 178/200

Arizona saw 1,017 scam reports in the first half of 2025, or 13.2 per 100,000 residents, making it one of the most affected states relative to population.

While the overall number of scams is lower compared to larger states, the median loss of $670 was the highest across the country. Arizonans lost $681,390 in total, showing that while scams are fewer, they tend to inflict severe financial damage per victim.

3. Georgia - 178/200

Georgia experienced 1,594 reported scams in the first half of 2025. With 14.1 reports per 100,000 residents, it ranks high in terms of prevalence relative to population. Financially, Georgians reported $706,142 in total losses, with a median loss of $443 per incident.

4. California - 173/200

California, the most populous state, unsurprisingly recorded the highest total number of scam reports, 4,432 in the first half of 2025. This equates to 11.2 reports per 100,000 residents, a lower per capita rate compared to smaller states but still significant in raw numbers. The Golden State saw $2.22 million in total losses, the largest in the country, with a median loss of $500 per victim. California’s size continues to make it a prime target for phone scammers.

5. Texas - 165/200

Texas ranked second in total scam reports, with 3,388 cases in the first half of 2025. On a per capita basis, this equals 10.6 scams per 100,000 residents, slightly lower than other top states. Texans reported $1.69 million in total financial losses, with a median loss of $500 per incident. The Lone Star State’s combination of high population and substantial losses keeps it firmly in the top five.

Breaking It Down: Where the Scams Hurt the Most

While the combined ranking tells us who bears the overall burden, the picture changes when you isolate individual factors.

Most Scammed States by Report Volume

Big states like California and Florida are attractive to scammers because of their sheer population and demographics. Florida’s large retiree base, for instance, is frequently targeted. Texas, with its busy metro areas also sees a steady flow of scam activity. Meanwhile, smaller states such as Maryland, Missouri, and Delaware may not top raw totals, but per capita, they face just as much exposure.

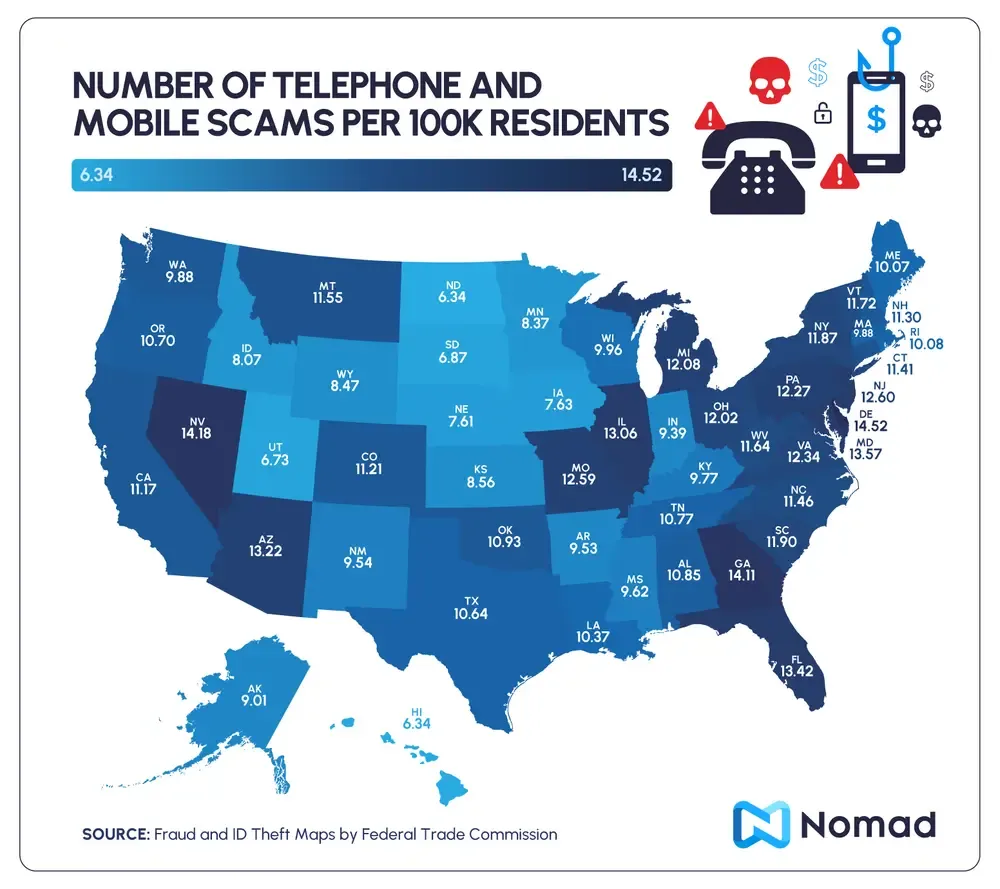

Here is how many scams per 100k each state reported in the first half of 2025:

States with the Highest Financial Losses

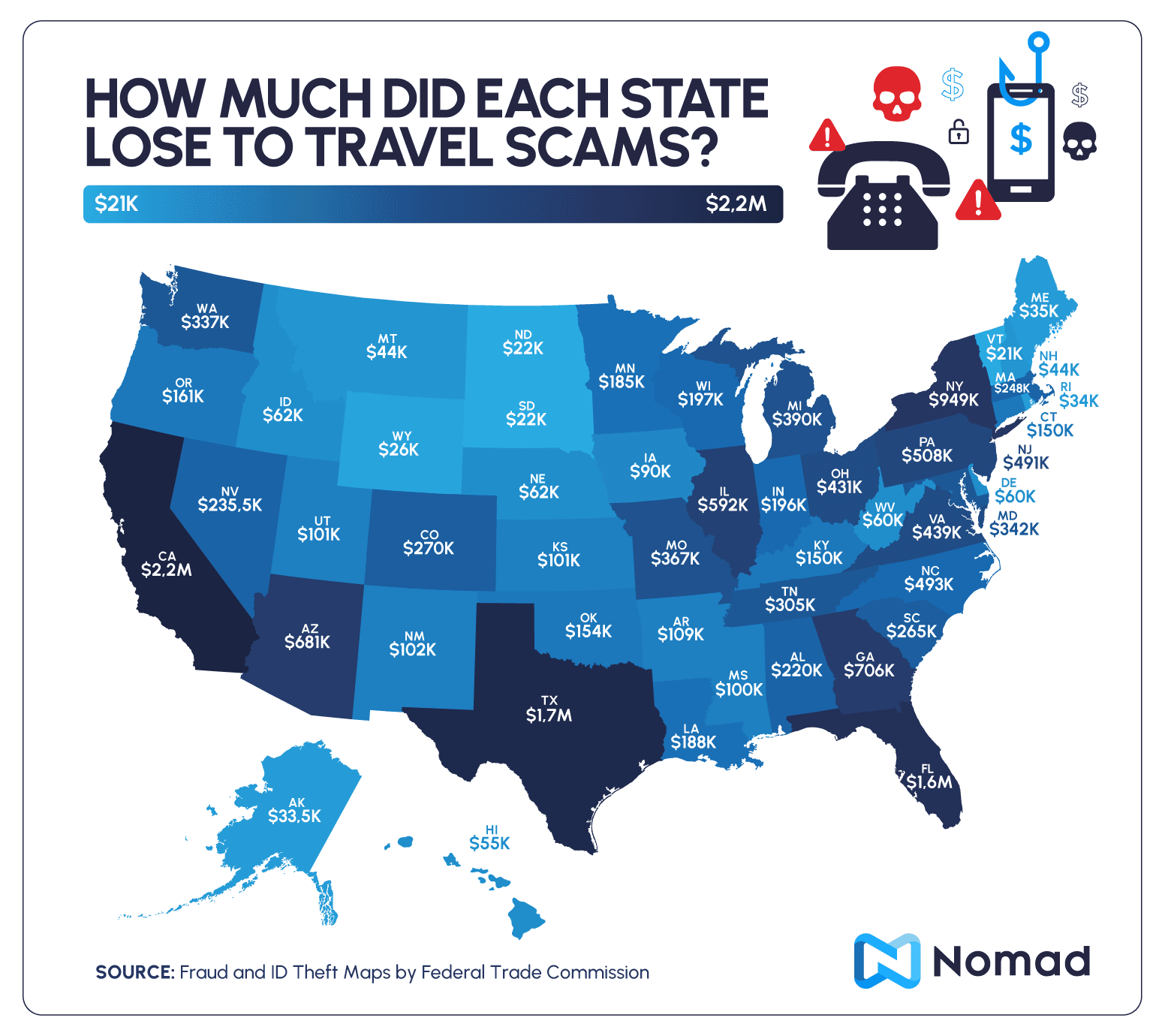

California again comes first with $2.22M in losses, followed by Texas ($1.69M) and Florida ($1.64M). New York ranks fourth at nearly $1M. Arizona and Georgia appear lower in totals but punch above their weight given population size.

Here, it’s not just volume but the depth of losses that stand out. California’s top ranking reflects both scale and scams that extract larger sums per victim. New York’s higher losses align with wealthier populations and urban centers where financial impersonation scams are common. Arizona and Georgia show that even with fewer reports, scams can be highly costly.

Here is how much each state loss to phone scams in the first half of 2025:

Types of Phone Scams to Watch Out For in 2025

Impersonation Scams

Scammers pose as banks, government agencies, or delivery companies and even friends and family to trick victims into sharing personal details or transferring money. These texts or calls often use “spoofed” numbers that look official, making them hard to distinguish from the real thing. The sense of authority and urgency is designed to make victims comply quickly.

Tech Support Scams

Scammers call or text claiming your device has a virus or security breach, then offer fake “support services” for a fee. Victims may be asked to install remote access software, giving scammers control of their devices and sensitive data. These scams are especially dangerous because they combine financial theft with identity theft.

Prize and Lottery Scams

Victims are told they’ve won a prize, vacation, or lottery, but must first pay taxes, fees, or deposits to claim it. These offers are designed to sound exciting and urgent, playing on greed and curiosity. The prize never exists, and the upfront payments go straight to the scammer.

Investment and Cryptocurrency Scams

Callers pitch “guaranteed” investment opportunities, often involving cryptocurrency or high-yield schemes. Victims are pressured into sending large sums with promises of quick returns that never materialize. These scams often target financially savvy individuals, making them particularly costly when successful.

5 Tips To Protect Yourself From Telephone and Mobile Scams in 2025

With scammers growing more sophisticated, vigilance is more important than ever. Here are five essential steps you can take:

1. Never Reply to a Suspicious Text

Treat unexpected phone calls or text messages with suspicion, especially if they ask for money, passwords, or personal details. A common trick is impersonating trusted institutions like banks, delivery companies, or government agencies.

If you get a call or text out of the blue, don’t respond directly. Instead, verify it through an official channel. That means calling your bank using the number on the back of your card, checking your delivery status through the company’s official app, or visiting a verified website.

Remember: a legitimate organization will never pressure you into sharing sensitive information over an unsolicited call or text.

2. Don’t Trust Caller ID

Caller ID used to be a helpful way to know who was contacting you. But today, it can be easily manipulated through “spoofing.” Scammers can make it look like they’re calling from a local number, a well-known business, or even a government agency.

Because of this, never rely solely on caller ID to confirm a caller’s legitimacy. If the person on the line asks for personal or financial details, it’s a red flag. The safest approach? Hang up and dial the company or agency directly using a verified number.

3. Be Cautious of “Too Good to Be True” Offers

Free vacations, lottery winnings, or “guaranteed” investment opportunities are classic hooks. Scammers use these offers to get your attention, then ask for a fee, a deposit, or your personal details in order to claim your prize or secure the deal.

If something sounds unbelievable, it probably is. Legitimate organizations don’t hand out prizes to people who never entered a contest, and real investments come with risks that no one can eliminate. Always research the company making the offer, and if you’re uncertain, it’s best to walk away.

4. Use Call-Blocking Tools

Both Android and iPhone devices come with built-in settings to silence or block suspected spam calls and texts. Turning these features on can drastically reduce the number of scam attempts that even reach you.

In addition, many carriers and third-party apps offer advanced call-filtering services that can screen robocalls, flag known scam numbers, and protect family members, especially vulnerable groups like older relatives or teenagers who may not recognize a scam right away.

5. Don’t click on links in text messages or emails

Cybercriminals often send links that look like they lead to trusted websites but actually direct you to fake login pages or install malware on your device. These phishing attempts can steal your passwords, credit card numbers, or even give hackers access to your phone. If you receive a link from an unknown sender, or even from a known contact but the message feels off, avoid clicking it. Instead, go directly to the official website or app to check the information safely.

Using an eSIM Can Help Protect Against Scams Too

Staying connected securely is one of the best ways to protect yourself from phone and mobile fraud. With more people relying on digital communication at home and abroad, using unsecure WiFi networks or juggling physical SIM cards can increase exposure to scams.

This is where eSIMS can make a difference. Unlike traditional SIM cards, eSIMS are built directly into your device and activated digitally, which brings both convenience and an extra layer of security.

An eSIM allows you to:

- Avoid risky public WiFi: many scams originate from fake WiFi hotspots. With Nomad eSIM you can rely on mobile data at affordable rates instead of connecting to suspicious networks.

- Lower SIM-swap risks: physical SIMs can be stolen or tampered with, whereas an eSIM is embedded in your device, which makes it much harder for cybercriminals to exploit.

- Top up securely on the go: With Nomad eSIM’s add-on data packs, you can avoid buying SIMs from unknown vendors, which also may present risks of being compromised.

Nomad eSIM offers affordable data plans in over 200 countries, and you can be sure to find one that is suitable for your travel needs. Data plans are available from as low as $1.10/GB. Whether you are traveling to Asia, Europe, or North America, Nomad’s travel eSIMs will provide you with data so that you can stay connected at affordable rates and without worries!

Methodology:

Using Fraud and ID Theft Maps created by the Federal Trade Commission, we gathered data specifically on telephone and mobile scams reported in each U.S. state from January 1st to June 30th, 2025.

We first identified the total number of scam reports per state, then calculated the rate of scams per 100,000 residents. From the same dataset, we recorded the median financial loss per victim and multiplied this by the number of reports to estimate total financial damage.

We then created an overall ranking based on four factors:

- number of reports,

- reports per capita,

- median loss per victim, and

- total reported losses.

Each factor was scored out of 50, adding up to a maximum possible score of 200. States with the highest combined scores represent those most severely impacted by telephone and mobile scams.